The Market Mood Index (MMI) is a powerful tool designed to gauge the overall sentiment of the stock market. By understanding the MMI, investors can gain valuable insights into market dynamics and make more informed trading decisions. In this blog, we will explore what the Market Mood Index is, how it works, and its significance in the context of the Indian stock market.

What is the Market Mood Index (MMI)?

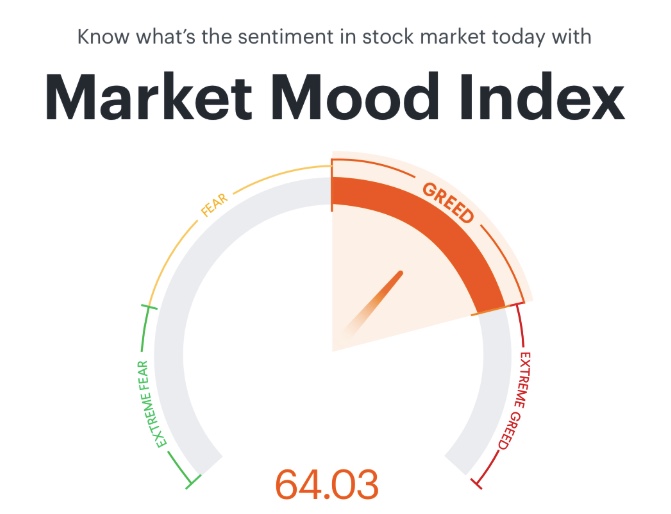

The Market Mood Index is an indicator that measures the collective sentiment of investors in the stock market. It helps identify whether the market is in a state of optimism, pessimism, or somewhere in between. The MMI is often represented on a scale ranging from extreme fear to extreme greed, with various stages of sentiment in between.

Key Components of MMI

- Market Data: The MMI uses various market data points, such as price movements, trading volumes, and volatility, to assess the overall mood of the market.

- Investor Sentiment: It incorporates data from surveys and polls that capture the sentiments of individual and institutional investors.

- Economic Indicators: Economic data such as GDP growth, inflation rates, and employment figures are also factored into the MMI to provide a comprehensive view of market sentiment.

How Does the Market Mood Index Work?

The MMI operates by aggregating and analysing a wide range of data to produce a single sentiment score. Here’s a step-by-step breakdown of how it works:

1. Data Collection

The MMI collects data from various sources, including stock prices, trading volumes, volatility indices, investor surveys, and economic reports. This data is continuously updated to reflect the latest market conditions.

2. Analysis and Scoring

The collected data is analyses using complex algorithms that weigh each data point according to its relevance and impact on market sentiment. The result is a sentiment score that indicates the prevailing mood of the market.

3. Interpretation

The sentiment score is then interpreted on a scale, typically ranging from 0 to 100. The scale is divided into different zones representing varying degrees of market sentiment:

- 0-20: Extreme Fear

- 20-40: Fear

- 40-60: Neutral

- 60-80: Greed

- 80-100: Extreme Greed

4. Application

Investors can use the MMI to gauge the market’s mood and adjust their strategies accordingly. For instance, during periods of extreme fear, investors might find opportunities to buy undervalued stocks, while periods of extreme greed may signal potential market bubbles and caution.

Significance of MMI in the Indian Stock Market

1. Informed Decision-Making

The MMI provides a snapshot of market sentiment, helping investors make more informed decisions. By understanding whether the market is driven by fear or greed, investors can better manage their risks and capitalize on market opportunities.

2. Timing the Market

While timing the market is notoriously difficult, the MMI can offer valuable clues about potential turning points. For example, a shift from extreme fear to neutral or greed may indicate a potential market recovery.

3. Risk Management

Understanding market sentiment is crucial for effective risk management. During periods of extreme sentiment, either fear or greed, the market can become highly volatile. The MMI helps investors anticipate such conditions and adjust their portfolios to mitigate risks.

4. Contrarian Investing

Contrarian investors, who aim to go against prevailing market trends, can use the MMI to identify when the market may be overreacting. For example, buying during extreme fear or selling during extreme greed can be part of a contrarian strategy.

Conclusion

The Market Mood Index is a valuable tool for understanding the sentiment driving the Indian stock market. By providing insights into whether the market is experiencing fear, greed, or neutrality, the MMI helps investors make more informed decisions, manage risks, and potentially capitalise on market opportunities. At Smart Disha Trader, we believe that staying informed about market sentiment is essential for successful investing. Use the MMI as part of your broader investment strategy to navigate the dynamic world of the stock market effectively.

Happy investing!