1. Weak global cues

Markets across the globe were in a sombre mood on Friday amid growing uncertainty over the outcome of the US presidential race. Weak Chinese macro data and deepening China-US trade tensions also weighed on sentiment.

2. Caution ahead of Union Budget F.Y. 2024-25

Back home, apart from weak global cues, caution ahead of the Union Budget, which will be presented on Tuesday Its Modi 3.0 First Full Budget , also kept investors away from riskier equities. There is hope that the government will announce a pro-growth budget that will keep the focus on fiscal consolidation and economic growth. Still, experts also anticipate some hues of populism.

said BY Ajit Mishra, SVP – Research, Religare Broking “This decline signals caution ahead of the Union Budget, as participants chose to book profits,” .

“We may see further dips in the Nifty, with the next crucial support at the 24,180 level, corresponding to the 21-day EMA (exponential moving average). Traders are advised to avoid aggressive positions and opt for hedged trades. For now, it is also recommended to focus on index majors rather than midcap and smallcap stocks,” said Mishra.

3. IT outage

Experts said reports of system outages across industries due to an issue with the Microsoft update also influenced sentiment.

“The domestic market closed today with a downturn due to the global sell-off, triggered by operating system issues that caused devices to crash worldwide. The global IT outrage has led to disruptions in various Indian industries. The overvalued market is also experiencing profit-booking ahead of the Budget next week. The recent performance has been bullish in anticipation of pro-industry and populist measures,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Markets plunged in the last hour trade on broad-based profit-taking. IT stocks, which held ground in early trades, too, gave up their gains, while other sectoral and broader indices incurred substantial losses after sentiment turned extremely bearish on weak global cues and reports of online businesses in several countries, including in India, hit by cyber outages,” said Prashanth Tapse, Senior VP (Research), Mehta Equities.

4. Concerns over valuation

Concerns over rich market valuation are also seen as a factor that triggered a profit booking. Nifty 50 is trading above its two-year average price-to-earnings (PE) ratio. As per the equity research platform Trendlyne, Nifty’s current PE is 23.6, which is above its two-year average PE of 21.9. Its current price-to-book (PB) ratio is 4.2, slightly above its two-year average PB of 4.1.

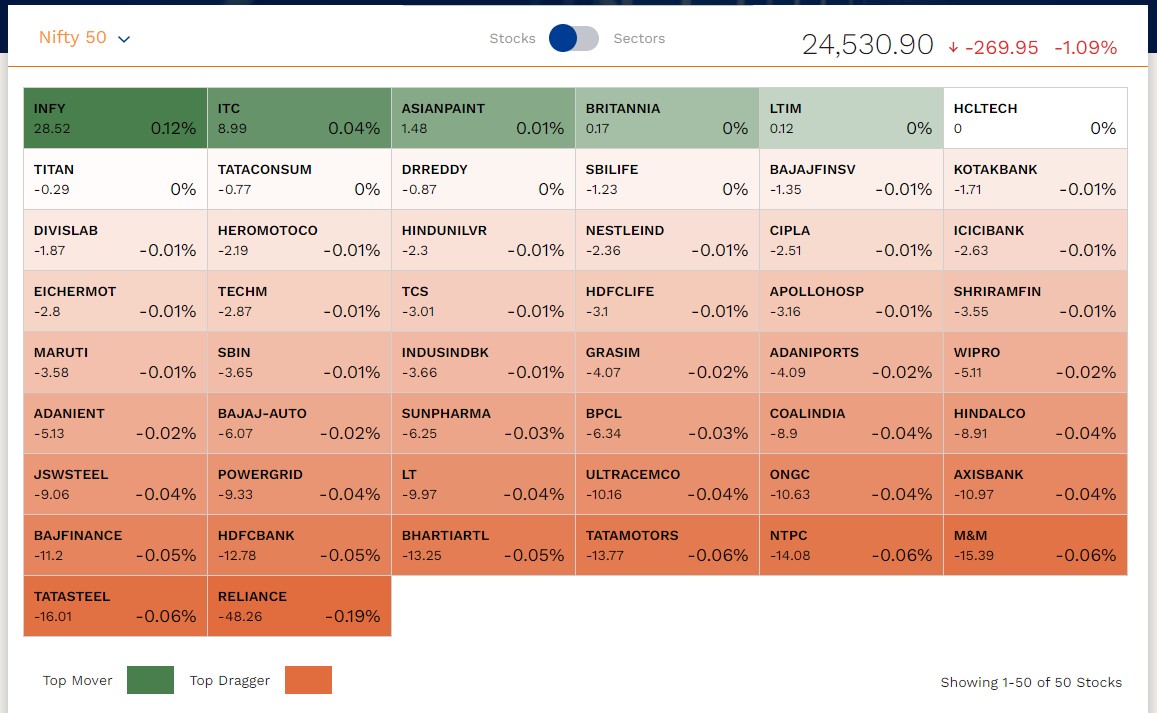

Nifty 50 Stock Performance Today

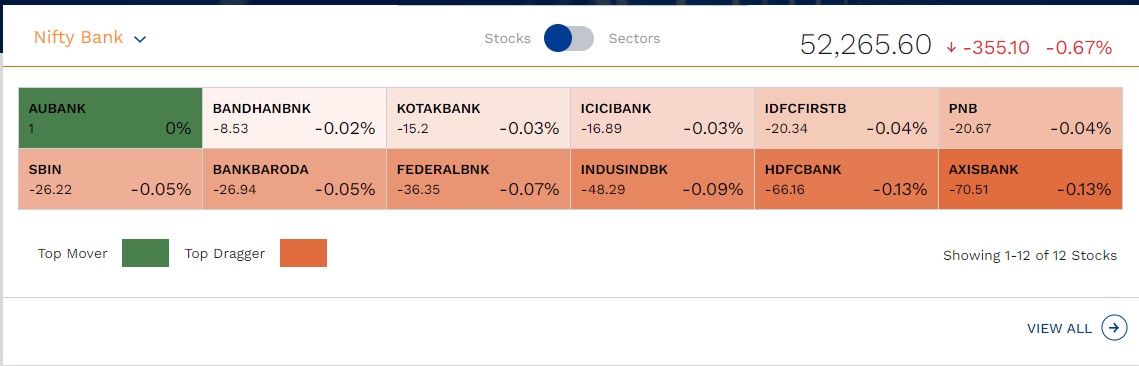

Bank Nifty Stock Performance Today

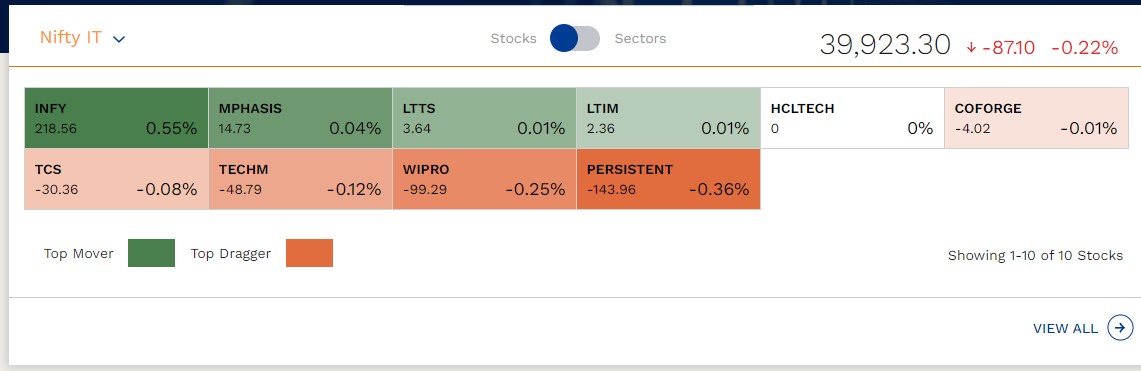

Nifty IT Stock Performance Today

Disclaimer: The views and recommendations above are those of individual analysts, experts, and brokerage firms, not Smart Trader Disha. We advise investors to consult certified experts before making any investment decisions.