Swing trading is a popular trading strategy that involves taking advantage of short to medium-term price movements in the stock market. At Smart Disha Trade, we understand the importance of selecting the right stocks to maximize your profits and minimize risks. Here’s a comprehensive guide on how to select stocks for swing trading.

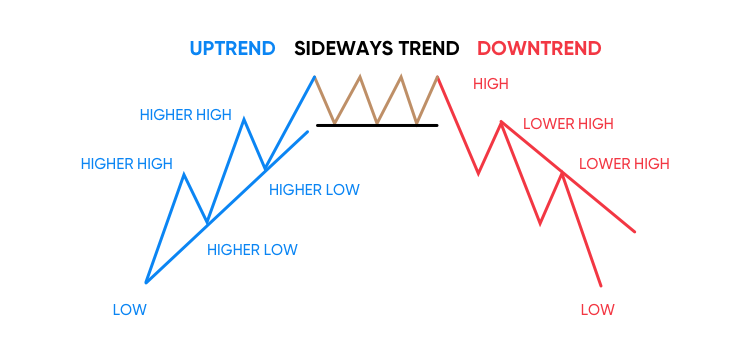

1. Identify Market Trends

Before selecting stocks, it’s crucial to understand the broader market trends. This involves analyzing major indices such as the BSE Sensex and NSE Nifty to determine the overall market direction. A bullish market trend indicates that most stocks are likely to rise, whereas a bearish trend suggests the opposite.

Tips:

- Use technical indicators like Moving Averages, RSI, and MACD to gauge market trends.

- Keep an eye on economic news and events that could impact the market.

2. Screen for Volatile Stocks

Volatility is a swing trader’s best friend. Stocks with higher volatility provide more trading opportunities due to their frequent price fluctuations. Look for stocks with a history of significant price movements within a short period.

As per above Chart of Raymond First Chart on Day Candle & Second Chart on 15 Min Time Frame

Tools:

- Stock screeners like Moneycontrol, TradingView, and StockEdge can help identify volatile stocks.

- Filter stocks based on criteria such as average true range (ATR) and historical volatility.

3. Focus on Liquid Stocks

Liquidity refers to how easily a stock can be bought or sold in the market without affecting its price. High liquidity ensures that you can enter and exit trades quickly and at desired prices.

Indicators:

- Look for stocks with high trading volumes.

- Check the bid-ask spread; narrower spreads indicate better liquidity.

4. Analysis Technical Indicators

Technical analysis is at the heart of swing trading. Use various technical indicators to identify potential entry and exit points.

Key Indicators:

- Moving Averages (MA): Use short-term (e.g., 20-day) and long-term (e.g., 50-day) moving averages to spot trends.

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Provides buy/sell signals based on momentum.

- Bollinger Bands: Indicate volatility and potential reversal points.

5. Check Earnings Reports and News

Fundamental factors like earnings reports and news events can significantly impact stock prices. Stocks with upcoming earnings announcements or those in the news tend to be more volatile.

Steps:

- Review quarterly earnings reports to gauge a company’s financial health.

- Stay updated with news related to the company, industry, and economy.

6. Use Chart Patterns

Chart patterns are visual representations of price movements that can help predict future movements. Common patterns include head and shoulders, double tops and bottoms, and triangles.

Popular Patterns:

- Head and Shoulders: Indicates a trend reversal.

- Double Top/Bottom: Suggests a reversal after a trend.

- Triangles: Symmetrical, ascending, or descending triangles indicate continuation or reversal.

7. Set Clear Entry and Exit Points

Successful swing trading requires clear entry and exit strategies to manage risk and lock in profits.

Strategies:

- Entry Points: Identify buy signals using technical indicators and patterns.

- Exit Points: Use stop-loss orders to limit losses and set target prices for taking profits.

8. Risk Management

Effective risk management is crucial to protect your capital. Only risk a small percentage of your trading capital on each trade and use stop-loss orders to manage potential losses.

Tips:

- Follow the 1% rule: Risk no more than 1% of your capital on a single trade.

- Diversify your trades to spread risk across different stocks and sectors.

Conclusion

Selecting the right stocks for swing trading involves a combination of market analysis, technical indicators, fundamental analysis, and risk management. At Smart Disha Trade, we recommend a systematic approach to identify and capitalize on short to medium-term price movements. By following these steps, you can enhance your swing trading strategy and improve your chances of success.

Happy Trading!

Feel free to customize this guide further or reach out to Smart Disha Trade for personalized advice and strategies tailored to your trading needs.